Chapter

|

Saving Communities

|

||||||

Home |

Site Map |

Index

|

New Pages |

Contacts |

|

CHAPTER XXVII: THE

LION IN THE WAY.

|

WE may now see why the advocacy of free trade has been so halting and half-hearted.

It is because the free-trade principle carried to its logical

conclusion would destroy that monopoly of nature's bounty which enables

those who do no work to live in luxury at the expense of “the poor

people who have to work,” that so-called free traders have not ventured

to ask even the abolition of tariffs, but have endeavored to confine

the free-trade principle to the mere abolition of protective duties. To

go further would be to meet the lion of “vested interests.”

In Great Britain the ideas of Quesnay and Turgot found a soil in which, at the time, they could grow only in stunted form. The power of the landed aristocracy was only beginning to find something of a counterpoise in the growth of the power of capital, and in politics, as in literature, Labor had no voice. Adam Smith belonged to that class of men of letters always disposed by strong motives to view things which the dominant class deem essential in the same light as they do, and who before the diffusion of education and the cheapening of books could have had no chance of being heard on any other terms. Under the shadow of an absolute despotism more liberty of thought and expression may sometimes be enjoyed than where power is more diffused, and forty years ago it would doubtless have been safer to express in Russia opinions adverse to serfdom than in South Carolina to have questioned slavery. And so, while Quesnay, the favorite physician of the master of France, could in the palace of Versailles carry his free-trade propositions to the legitimate conclusion of the impôt unique, Adam Smith, had he been so radical, could hardly have got the leisure to write “The Wealth of Nations” or the means to print it.

I am not criticizing Adam Smith, but pointing out conditions which have affected the development of an idea. The task which Adam Smith undertook — that of showing the absurdity and impolicy of protective tariffs — was in his time and place a sufficiently difficult one, and even if he saw how much further than this the principles he enunciated really led, the prudence of the man who wishes to do what may be done in his day and generation, confident that where he lays the foundation others will in due time rear the edifice, might have prompted him to avoid carrying them further.

However this may be, it is evidently because free trade really goes so far, that British free traders, so called, have been satisfied with the abolition of protection, and, abbreviating the motto of Quesnay, “Clear the ways and let things alone,” into “Let things alone,”* have shorn off its more important half.** For one step further — the advocacy of the abolition of revenue tariffs, as well as of protective tariffs — would have brought them upon dangerous ground. It is not only, as English writers intimate to excuse the retaining of a revenue tariff, that direct taxation could not be resorted to without arousing the British people to ask themselves why they should continue to support the descendants of royal favorites, and to pay interest on the vast sums spent during former generations in worse than useless wars; but it is that direct taxation could not be advocated without danger to even more important “vested interests.” One step beyond the abolition of protective duties, and the British free-trade movement must have come full against that fetish vvhich for some generations the British people have been taught to reverence as the very Ark of the Covenant — private property in land.

For in the British kingdoms (save in Ireland and the Scottish Highlands) private property in land was not instituted in the short and easy way in which Will Atkins endeavored to institute it on Crusoe's island. It has been the gradual result of a long series of usurpations and spoliations. In the view of British law there is to-day but one owner of British soil, the Crown — that is to say, the British people. The individual landholders are still in constitutional theory what they once were in actual fact — mere tenants. The process by which they have become virtual owners has been that of throwing upon indirect taxation the rents and taxes they were once held to pay in return for their lands, while they have added to their domains by fencing in. the commons, in much the same manner as some of the same class have recently fenced in large tracts of our own public domain.

The entire abolition of the British tariff would involve as a necessary consequence the abolition of the greater part of the internal indirect taxation, and would thus compel heavy direct taxation, which would fall not upon consumption but upon possession. The moment this became necessary, the question of what share should be borne by. the holders of land must inevitably arise in such a way as to open the whole question of the rightful ownership of British soil. For not only do all economic considerations point to a tax on land values as the proper source of public revenues; but so do all British traditions. A land tax of four shillings in the puund of rental value is still nominally enforced in England, but being levied on a valuation m.ade in the reign of William III., it amounts in reality to not much over a penny in the pound. With the abolition of indirect taxation this is the tax to which men would naturally turn. The resistance of landholders would bring up the question of title, and thus any inovement which went so far as to propose the substitution of direct for indirect taxation must inevitably end in a demand for the restoration to the British people of their birthright.

This is the reason why in Great Britain the free-trade principle was aborted into that spurious thing “British free trade,” which calls a sudden halt to its own principles, and after demonstrating the injustice and impolicy of all tariffs, proceeds to treat tariffs for revenue as something that must of necessity exist.

In assigning these reasons for the failure to carry the free-trade movement further than the abolition of protection, I do not, of course, mean to say that such reasons have consciously swayed free traders. I am definitely pointing out what by them has been in many cases doubtless only vaguely felt. We imbibe the sympathies, prejudices and antipathies of the circle in which we move, rather than acquire them by any process of reasoning. And the prominent advocates of free trade, the men who have been in a position to lead and educate public opinion, have belonged to the class in which the feelings I speak of hold sway — for that is the class of education and leisure.

In a society where unjust division of wealth gives the fruits of labor to those who do not labor, the classes who control the organs of public education and opinion — the classes to whom the many are accustomed to look for light and leading, must be loath to challenge the primary wrong, whatever it may be. This is inevitable, from the fact that the class of wealth and leisure, and consequently of culture and influence, must be, not the class which loses by the unjust distribution of wealth, but the class which (at least relatively) gains by it.

Wealth means power and “respectability,” while poverty means weakness and disrepute. So in such a oociety the class that leads and is looked up to, while it may be willing to tolerate vague generalities and impracticable proposals, must frown on any attempt to trace social evils to their real cause, since that is the cause that gives their class superiority. On the other hand, the class that suffers by these evils is, on that account, the ignorant and uninfluential class, the class that, from its own consciousness of inferiority, is prone to accept the teachings and imbibe the prejudices of the one above it; while the luen of superior ability that arise within it and elbow their way to the front are constantly received into the ranks of the superior class an.d interested in its service, for this is the class that has rewards to give. Thus it is that social injustice so long endures and is so difficult to make head against.

Thus it was that in our Southern States while slavery prevailed, the influence, not only of the slaveholders themsolves, but of churches and colleges, the professions and the press, condemned so effectually any questioning of slavery, that men who never owned and never expected to own a slave were ready to persecute and ostracize anyone who breathed a word against property in flesh and blood-ready, even, when the time came, to go themselves and be shot in defense of the “peculiar institution.”

Thus it was that even slaves believed abolitionists the worst of humankind, and were ready to join in the sport of tarring and feathering one. And so, an institution in which only a comparatively small class were interested, and which was in reality so unprofitable, even to them, that now that slavery has been abolished, it would be hard to find an ex-slaveholder who would restore it if he could, not only dominated public opinion where it existed, but exerted such influence at the North, where it did not exist, that “abolitionist” was for a long time suggestive of “atheist,” “communist” and “incendiary.”

The effect of the introduction of steam and labor-saving machinery upon the industries of Great Britain was such a development of manufactures as to do away with all semblance of benefit to the manufacturing classes from import duties, to raise up a capitalistic power capable of challenging the dominance of the “landed interest,” and by concentrating workmen in towns to make of them a more important political factor. The abolition of protection in Great Britain was carried, against the opposition of the agricultural landholders, by a combination of two elements, capital and labor, neither of which would, of itself, have been capable of winning the victory. But, of the two, that which was represented by the Manchester manufacturers possessed much more effective and independent strength than that whose spirit breathed in the Anti-Corn-Law rhymes. Capital furnished the leadership, the organizing ability and the financial means for agitation, and when it was satisfied, the further progress of the free-trade movement had to wait for the growth of a power which, as an independent factor, is only now beginning to make its entrance into British politics. Any advance toward the abolition of revenue duties would not only have added the strength of the holders. of municipal and mining land to that of the holders of agricultural land, but would also have arrayed in opposition the very class most efficient in the free-trade movement. For, save where their apparent interests come into clear and strong opposition, as they did in Great Britain upon the question of protective duties, capitalists as a class share the feelings that animate landholders as a class. Even in England, where the division between the three economic orders — landholders, capitalists and laborers — is clearer than anywhere else, the distinction between landholders and capitalists is more theoretical than real. That is to say, the landholder is generally a capitalist as well, and the capitalist is generally in actuality or expectation to some extent a landholder, or by the agency of, leases and mortgages is interested in the profits of landholding. Public debts and the investments based thereon constitute, moreover, a further powerful agency in disseminating through the. whole “House of Have” a bitter antipathy to anything that might bring the origin of property into discussion.

In the United States the same principles have operated, though

owing to differences in industrial development the combinations have

been different. Here the interest that could not be “protected” has

been the agricultural, and the active and powerful manufacturing

interest has been on the side of protective duties. And though the

“landed interest” here has not been so well intrenched politically as

in Great Britain, yet not only has land-ownership been more widely

diffused, but our rapid growth has interested a larger proportion of

the present population in anticipating, by speculation based on

increasing land values, the. power of levying tribute on those yet to

come. Thus private property in land has been in reality even stronger

here than in Great Britain, while it has been to those interested in it

that the opponents of protection have principally appealed. Under such

circumstances there has been here even less disposition than in Great

Britain to carry the free-trade principle to its legitimate

conclusions, and free trade has been presented to the American people

in the emasculated shape of a “revenue reform” too timid to ask for

even “British free trade.”

Online editor's footnotes:

*“Laissez faire, laissez passer” which means “Let be; let pass.” Thomas Jefferson's observation about French lords denying access to land mirrors this recommendation:

I asked myself what could be the reason that so many should be permitted to beg who are willing to work, in a country where there is a very considerable proportion of uncultivated lands? These lands are kept idle mostly for the sake of game. It should seem then that it must be because of the enormous wealth of the proprietors which places them above attention to the increase of their revenues by permitting these lands to be laboured.

— Letter to James Madison, Sr., from Fountainebleu, France, October 28, 1785

** I think George was too hard on the English free traders here. Adam Smith was highly critical of land monopoly in Wealth of Nations:

As soon as the land of any country has all become private property, the landlords, like all other men, love to reap where they never sowed, and demand a rent even for its natural produce. The wood of the forest, the grass of the field, and all the natural fruits of the earth, which, when land was in common, cost the labourer only the trouble of gathering them, come, even to him, to have an additional price fixed upon them. He must then pay for the licence to gather them; and must give up to the landlord a portion of what his labour either collects or produces. This portion, or, what comes to the same thing, the price of this portion, constitutes the rent of land, and in the price of the greater part of commodities makes a third component part.

— Book 1, Chapter 6: Of the Component Parts of the Price of Commodities

RENT, considered as the price paid for the use of land, is naturally the highest which the tenant can afford to pay in the actual circumstances of the land....

The rent of land, therefore, considered as the price paid for the use of the land, is naturally a monopoly price. It is not at all proportioned to what the landlord may have laid out upon the improvement of the land, or to what he can afford to take; but to what the farmer can afford to give....

They [the landed aristocracy] are the only one of the three orders whose revenue costs them neither labour nor care, but comes to them, as it were, of its own accord, and independent of any plan or project of their own. That indolence, which is the natural effect of the ease and security of their situation, renders them too often, not only ignorant, but incapable of that application of mind which is necessary in order to foresee and understand the consequences of any public regulation.

— Book 1, chapter 11: "Of the Rent of Land"

Ground-rents are a still more proper subject of taxation than the rent of houses. A tax upon ground-rents would not raise the rents of houses. It would fall altogether upon the owner of the ground-rent, who acts always as a monopolist, and exacts the greatest rent which can be got for the use of his ground.... Whether the tax was to be advanced by the inhabitant, or by the owner of the ground, would be of little importance. The more the inhabitant was obliged to pay for the tax, the less he would incline to pay for the ground; so that the final payment of the tax would fall altogether upon the owner of the ground-rent....

Both ground-rents and the ordinary rent of land are a species of revenue which the owner, in many cases, enjoys without any care or attention of his own. Though a part of this revenue should be taken from him in order to defray the expences of the state, no discouragement will thereby be given to any sort of industry. The annual produce of the land and labour of the society, the real wealth and revenue of the great body of the people, might be the same after such a tax as before. Ground-rents, and the ordinary rent of land, are, therefore, perhaps, the species of revenue which can best bear to have a peculiar tax imposed upon them.

Ground-rents seem, in this respect, a more proper subject of peculiar taxation than even the ordinary rent of land. The ordinary rent of land is, in many cases, owing partly at least to the attention and good management of the landlord. A very heavy tax might discourage too much this attention and good management. Ground-rents, so far as they exceed the ordinary rent of land, are altogether owing to the good government of the sovereign, which, by protecting the industry either of the whole people, or of the inhabitants of some particular place, enables them to pay so much more than its real value for the ground which they build their houses upon; or to make to its owner so much more than compensation for the loss which he might sustain by this use of it. Nothing can be more reasonable than that a fund which owes its existence to the good government of the state, should be taxed peculiarly, or should contribute something more than the greater part of other funds, towards the support of that government.

— Book 5, Chapter 2: Of the Sources of the General or Public Revenue of the Society

I agree with you to the letter in all you say about Ireland. – There is no doubt that the land question (coupled with the Church establishment) is at the root of the evil. – And here let me say that I go heartily with you in the determination to attack the land monopoly root and branch, both here [in England] & in Ireland and Scotland....

But, however unprepared the public may be for our views on the land question, I am ready to incur any obloquy in the cause of Economical truth. And it is I confess on this class of questions, rather than on plans oforganic reform, that I feel disposed to act the part of a pioneer. – The extension of the suffrage [to those without land] must & will come, but it chills my enthusiasm upon the subject when I see so much popular error & prejudice prevailing upon such questions as the Colonies, religious freedom, & the land customs of this country.

— Letter to John Bright, October 1, 1851

The landholder who spends his money in Paris or Naples cannot find revenue for the Minister. The revenue flourishes when the trading and commercial community are prosperous, and when the farmers are crying out under excessive distress; and, on the other hand, just in proportion as the land-owner feels prosperous on account of the starvation of the millions, the revenue of the State falls off.

— Her Majesty's Speech — Amendment on the Address, House of Commons, August 25, 1841

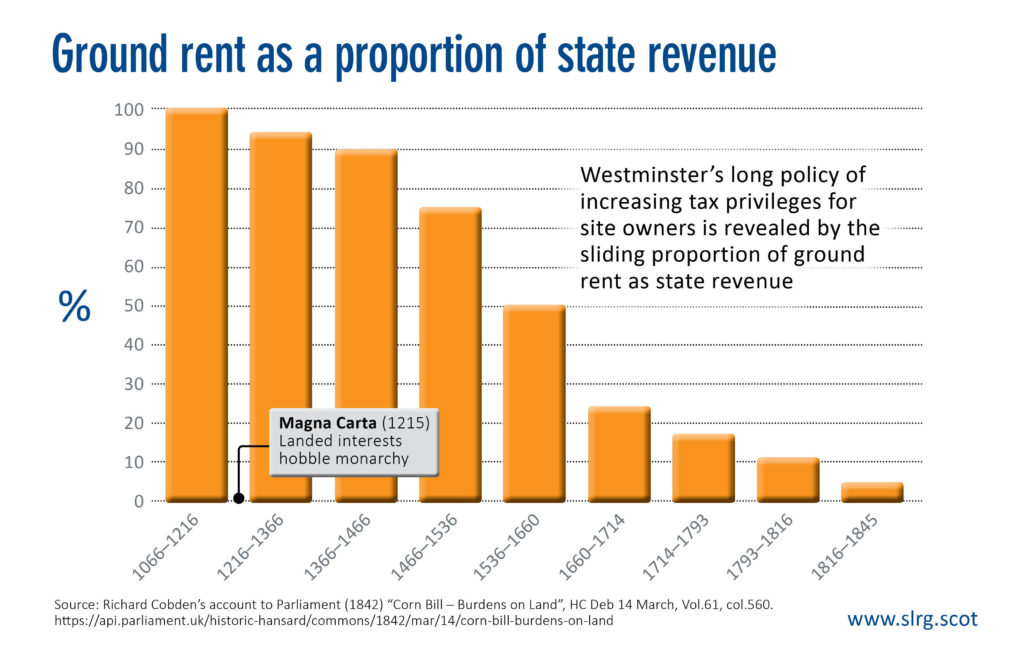

There are endless examples of Cobden attacking land monopoly. Similarly, the free trader William Cobbett, in testimony before Parliament, detailed the reduction in land value taxes that proceeded from the Magna Carta, which gave landlords supremacy over kings. This chart is derived from Cobbett's testimony:

Comments:Saving Communities

420 29th Street

McKeesport, PA 15132

United States

412.OUR.LAND

412.687.5263